Why Datanamix?

Continuously protect and sustain your company

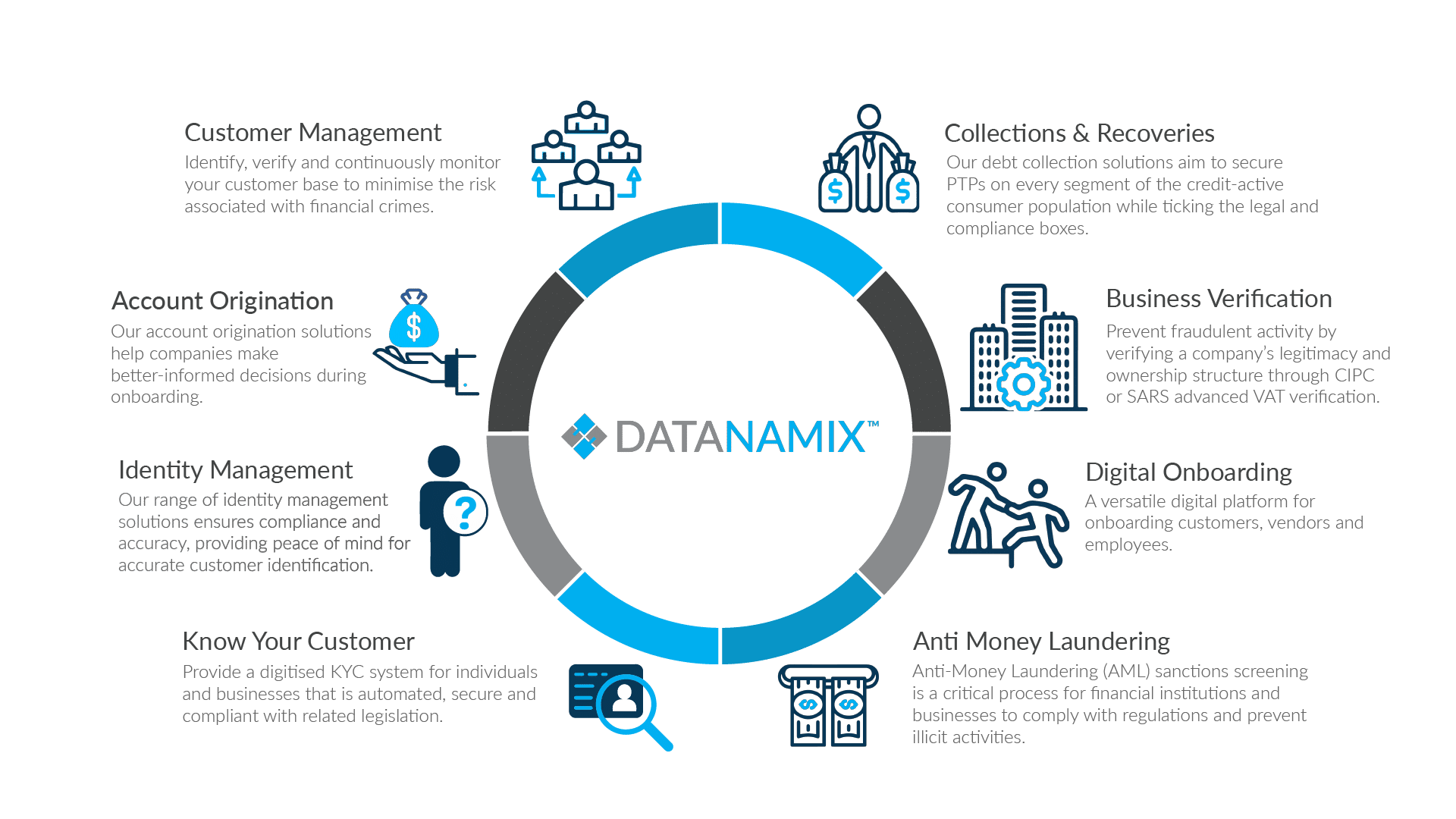

We protect and empower your company with KYC data to gain insight into your current and potential customers. Whether it is identity management, account management or even collections & recovery we have a comprehensive selection of unparalleled digital bureau and KYC data services to enrich any of your company processes.

Solutions at every stage of the customer's journey

Gain full access to an extensive variety of KYC bureau products, which can assist you in reducing your company’s risk and facilitating better-informed decisions.

See what’s new in our world

Solutions for every sector and industry requirements

Our services are tailored to meet the requirements of any sector or industry you may be in. With our expertise, we provide solutions designed to empower your business’s digital KYC processes.

More leaders using Datanamix

Make the first move

Feel free to contact us directly or complete the contact request